The two best funds for investing in democracy... and why I don’t use them

In 2007, Trish and I took the girls abroad to France, the UK and Ukraine. We had made a life plan to travel the world for a year. I had business there and combined it with family travel. As kids, 3 and 6, my daughters played on the Volga. It was just another artificial beach with imported sand on a river somewhere.

The girls are now in college and know the history better. Ukraine is a special place to them because of that trip, subsequent trips to Poland and Lithuania, and because my late wife's ancestors were from that area. In 2020 and again in 2021 they had tickets to Eastern Europe, including Ukraine, but were thwarted by Covid-19.

They will still (hopefully) go to Eastern Europe, but Ukraine is clearly off the itinerary. It was so hard to read the newspaper as things escalated there. Our hearts are with the people, the defenders, the vulnerable, and the families of loved ones that are dying on the battlefield. War is terrible anywhere.

Sanctions and financial pressure have caused the Ruble to plummet almost 35% and Russia's central bank doubled interest rates to 20%. The Russian stock market, if it were even open, is down over 50% since the start of the crisis. US registered ETFs (like RSX and ERUS) that track the Russian stock market are still trading even though the underlying stocks have been halted in Moscow. This happened in the past during the Greek default and the Arab Spring.

Russia has lost the financial credibility it worked to regain after the 1998 default. It may even be declared uninvestable by the influential people that set global market indices. (These are the same influential people that will not let South Korea graduate from ‘emerging’ into 'developed' economy index.) Being removed from the indexes would cause trillions in index fund investments to sell or write off Russian equities overnight.

I shed no tears for the men causing this war though. My cynicism expects them to not suffer deeply. For nearly two decades of my professional life, I worked for international nonprofit organizations promoting rule of law, freedom of speech, and fair elections, much of that work was in the former Soviet republics. Democracy is a cause I deeply care about and the last 16 years have not been easy. Democracy is contracting globally.

Where are the Socially Responsible Investing funds supporting democracy? SRI had been around for 50 years when Pax World Fund launched. It’s only recently that funds using freedom indexes have emerged. Coincidentally perhaps, it's about the same time frame as the growth of the anti-democracy funds, but those are focused on the USA.

So which ETFs support democracy? For starters, there is a Democrat ETF called DEMZ which tracks an 'index' of companies that embrace progressive values and are big contributors to the US Democratic party. (Top holdings: M&T Bank, Costco, Apple). That's not what we are talking about.

Two funds 'Freedom 100 Emerging Markets' and 'Democracy International' focus on freedom outside the US. Both promise to invest more heavily in countries that score higher on measures of freedom and avoid those that are not.

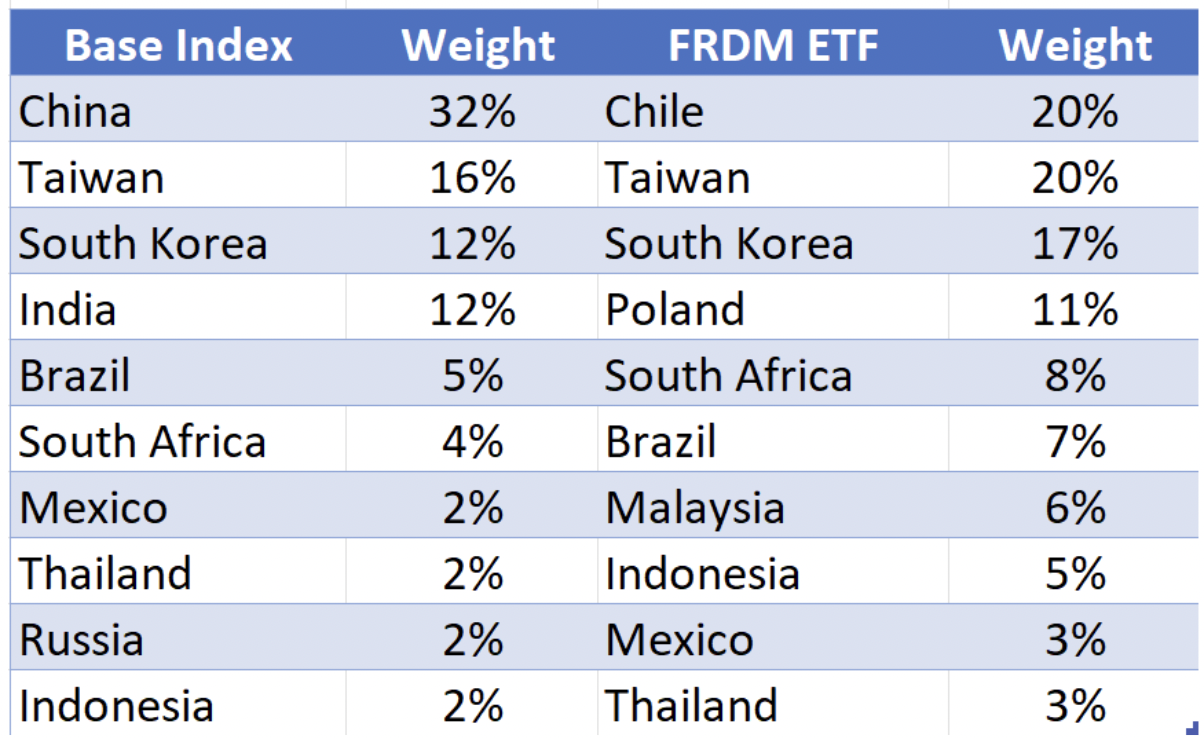

FRDM starts with emerging market countries from MSCI, the people considering delisting Russia (which is an emerging market.) It weights each country on a number of factors including level of freedom and size of the stock market.

The fee is a little high at .49%, even for emerging markets funds (which are usually the most expensive funds I use.) The cheapest emerging market index funds are .10-.15%. And the number of stock holdings, 100, is too low for my liking. I would prefer double that at least.

The biggest issue is that, like the base MSCI index, EEM is heavily concentrated in the top four countries. For all the effort they went through to construct a freedom index-based ETF, the big improvement is exchanging Chile and Poland for China and India (aaaand this sounds like I'm playing Risk). Don’t get me wrong, Chile and Poland deserve investment.

But I would be paying .39% more in fees every year just for that. I want to love this fund, but I can’t justify it based on cost.

Less interesting is DMCY which does a similar thing to FRDM but ends up in a different place. The Economist Intelligence Unit annually produces a democracy index which, along with market size, is used to build the country weighting.

DMCY shares the same outcome as FRDM. For all the effort, it's mostly just a broad developed economy international fund without China.

Interestingly, there are an enormous number of funds that do not claim to be ‘freedom’ focused that exclude China already. It’s been (xenophobically?) trendy to offer funds that exclude China usually with the reason that China manipulates its stock market.

If I’m paying a lot more, I like to know I’m making a big difference in my portfolio or with the impact of the fund. This is an interesting case where a smart systematic index/ETF construction doesn’t end up making enough of a difference to be worth the costs. I hope for future improvements.