Estimating the future cost of college

One of the most important skills of a financial planner is knowing roughly how much things will cost today and in the future. Long-term care insurance for a healthy female in her 50’s? Probably $500 a month in today’s dollars. Monthly Medicare (with part D and Medigap) for someone at 65 in 2045? About $1500 a month at 5% medical cost inflation.

Are these accurate? Obviously, everyone will have different insurance ratings and inflation will neither be constant, nor evenly spread across consumption. For a long-term estimate they are close enough. Unless the numbers are astronomically wrong, they are unlikely to make or break a retirement plan.

College costs are difficult to estimate even for planners. We all know tuition has been rising significantly. But costs have gone through higher and lower inflationary phases (see below) making it tough to forecast. And there is complexity in the data. For instance, tuition has gone up more than room and board over the years, so eyeball-seeking websites use tuition statistics and pretty graphs for more dramatic headlines.

College has a big impact on a family’s long-term finances. It’s a large expense that comes relatively quickly in the family financial lifecycle, so there isn’t a lot of time to see salary improvements and allow for beautiful, compound interest to do its magic.

Let’s get something out of the way. Access to affordable and effective education is a critical part of any economy. The above-inflation rise in educational costs combined with wage stagnation on the lower end causes more economic stratification and is a serious social problem. Our nation deserves better.

Most of us know college prices have gone up a lot faster than the Consumer Price Index, our general benchmark for inflation. But how much faster? What should you and I assume today about the cost of a four-year college in 18 years?

In this article, I’ll use 4-year undergraduate with room and board stated in the 2021 freshman year annual price, unless specified otherwise. And public college or university means in-state tuition/room and board. Out-of-state public college or university tuition/room and board is closer to private schools in terms of costs.

According to the College Board survey, between 1991 and 2021, the average price for public four-year, full-time college tuition with room-board was ~$12,000 more per year ($10,760 vs $22,690) after CPI inflation. The increase for private was nearly double the public - $24,000 ($28,000 vs $51,690)

Therefore, the after-CPI average for public 4-year college is about 2.5% for public and 2% for private. Over that time frame, CPI was 2.2%. Add them together and we get a 30-year grand total increase of 4.7% for public and 4.2% for private. Phew!

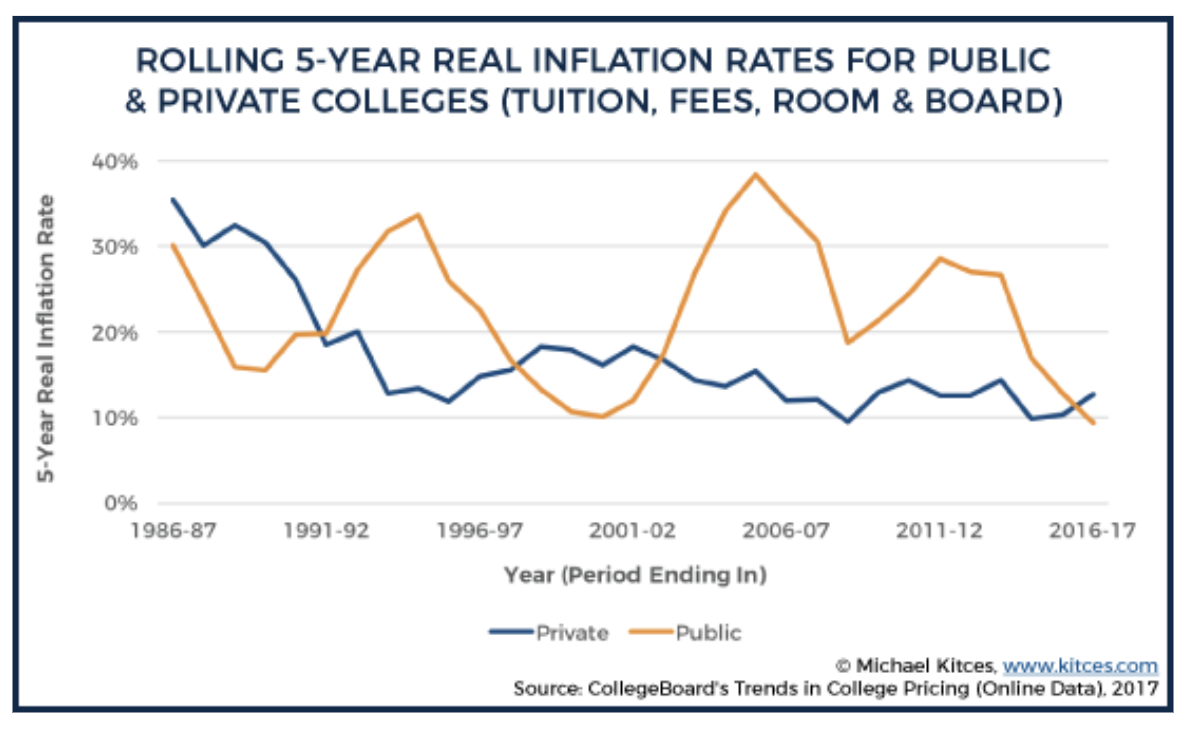

That 4.7% public and 4.2% private 30-year increases don’t tell the real story. Here’s a graph from researcher Michael Kitces’s site looking at rolling five year inflation adjusted (real) tuition increases from the mid-eighties to the mid-teens.

It’s not a linear average at all. You can see huge increases in the 80’s for both public and private. The private costs stabilize while the public fluctuates widely. The fluctuation is usually attributed to the lack of endowments for public colleges that operate on use-or-lose state budgets which themselves have to be balanced despite big changes in tax revenue through economic cycles.

At one point in 2014, the 5-year average increase for public four-year was nearly 8% a year! So, it’s not a surprise that many planners are still using higher 6% or 7% college cost inflation. 7% is conservative for some, but I see 15% on many planner websites, which I don’t think can be supported by any data. Maybe that’s a scare tactic? Hopefully, they don’t use that number in planning.

The estimate can make a big difference in a plan. Using 2021’s average rates for a four-year private college, a child born today will pay $188,000 in the 2040 freshman year at the 7% inflation rate. At the 30-year average we calculated above (4.2%), the same child will pay $117,000 ($71k less).

So, what’s my number? Given that inflation is running higher in the near-term, I use 5% total increases (including CPI) for college costs 18 years in the future. That kid born today should prepare for a private college annual cost of about $137,000 and a public college annual cost of $66,000 in my plans.

There’s faint hope it might be lower. College costs actually went up less than inflation for the first time in 2021, certainly related to declining pandemic enrollment and inflation spiking. There are mixed reports, however. (Did I mention how hard it is to get a solid estimate?)

This review doesn’t capture anything close to the whole picture. Location, institution, endowment, college aid, interest rates on loans, after-college wages, grandparent contributions, and benefits of tax-deferred accounts like 529s all dynamically alter the plan.

The only thing we can all count on, even at modest nonprofit professional salaries, is that there won’t be any need-based aid from public institutions. Like you, I value education, especially liberal arts. I’m making it work right now with two kids in college. You will too.